If this year’s Vinyl Survey is an accurate barometer of the upcoming (in August) State of the Industry Report, then non-electric sign companies had a great 2006. Although this year’s response rate has been eerily similar to the past two years, which makes comparisons much easier, many of this year’s results suggest that sign companies ignored Major League Baseball’s ban on steroids.

Overall, this year’s results shed much more light on the nature of signshops that use vinyl than they do about the product itself. Curiously, we see a huge increase in the use of digital imaging, even though the printing medium is hardly new. A disproportionate number of respondents plan to buy some type of printer in 2007.

Here are some of the eye-popping results, which are all the more impressive because this survey is more than a decade old. We even deleted a response from a $30 million company that primarily produces POP displays. The next biggest company showed $4 million in sales, so inclusion of the behemoth company would have significantly skewed some of the results.

Subsequent commentary about the tables will follow chronologically. Also, remember that “this year,” refers to 2006, and “last year” refers to 2005, with the exception of anticipated equipment expenditures (Table 18).

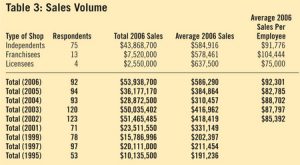

• The average sales volume of more than $586,000 is at least 40% higher than any prior year (Table 3).

Advertisement

• Sales per employee ($92,301) is the highest yet recorded (Table 3).

• The amount of money spent on vinyl is the highest yet reported (Table 5).

• Surprisingly, the percentage of signs that incorporate vinyl is by far the lowest ever reported (Table 7).

• Use of vinyl as a substrate is the second lowest in more than a decade (Table 9).

• Use of more vinyl, paint and screenprinting to decorate vinyl substrates all plummeted, while the use of digital imaging skyrocketed (Table 10).

• The number of rolls of vinyl kept in stock is the highest in four years (Table 11), but the number of colors of vinyl kept in stock slightly declined. (Table 12).

Advertisement

• Although the quality of calendered vinyl has improved significantly over the past several years, respondents prefer cast vinyl more now than in any of the four years in which we’ve tracked this (Table 13).

• The percentage of companies that own some type of digital-imaging equipment is noticeably higher than any other year (Table 15).

• The number of companies that sell digitally printed signs is the highest yet (Table 16).

• Similarly, digital printing is much more common for all types of signage (Table 17).

• Planned equipment investment for 2007 is much higher than in any previous year (Table 18).

Our respondents

Advertisement

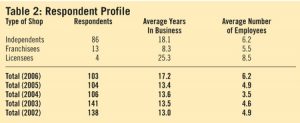

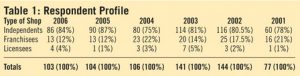

Table 1 shows uncanny consistency in both the total number of responses and the mix of types of respondents the past two years. Basically, the only change is three licensees replacing four independent sign companies. The consistency of total responses over the past three years would seemingly have to be more than coincidence as well. Either way, it makes yearly comparisons much easier.

Given the above, one might presume we’re getting responses from the same companies every year. The huge jump in the average number of years in business (Table 2) nixes that notion. After four consecutive years of companies averaging 13 years in existence, this year’s average jumped to more than 17 years, which suggests the continuing stability of commercial sign companies (or perhaps a propensity for older sign companies to fill out surveys).

The exception is the franchise respondents, who last year averaged more than a decade in business. The lone licensee last year was eight years old, while this year’s four respondents have been operating for more than a collective century.

Also in Table 2, we see a huge leap in the average number of employees. While it may seem small at 1.3 additional people, this represents an approximate 25% increase across the board. Again, only the franchises saw a decrease in average number of employees, from 6.3 to 5.5.

The average sales volume of $586,290 represents an approximate 40% increase over the highest total in any previous year, and nearly triples each of the first three years of this study (Table 3). Similarly, the average sales per employee ($92,301) also set a new standard, which is expected because, generally, the larger the company, the higher its sales per employee.

That figure is slightly lower than that calculated for the 2006 CAS/ Commercial SOI report, $94,500 (see ST, August 2006, page 97, Table 21). The franchises’ sales-per-employee figure is their best yet and second consecutive of more than $100,000.

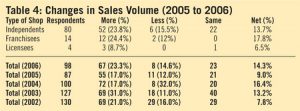

Table 4 helps determine if a study simply reflects responses from bigger companies, or if average sales volumes really increased in the past year. We see an average sales-volume increase of 14.3%, which is the second best in our five years of tracking this. Going back to Table 3, we see that the average sales volume of $58,290 is 52% higher than last year’s $384,864, so, essentially, we simply have responses from larger companies this year, but they also had a very good 2006. Roughly two thirds of our respondents enjoyed increased sales in 2006, and less than 8% suffered declining sales.

Complete survey results appear in the February 2007 issue, pages 96-101 of Signs of the Times. You can order the issue at https://www.stmediagroup.com/secure/index.php3?d=pubs&p=st&a=pu

Tip Sheet4 days ago

Tip Sheet4 days ago

Business Management2 weeks ago

Business Management2 weeks ago

Women in Signs2 weeks ago

Women in Signs2 weeks ago

Real Deal5 days ago

Real Deal5 days ago

Benchmarks1 day ago

Benchmarks1 day ago

Editor's Note1 week ago

Editor's Note1 week ago

Line Time2 weeks ago

Line Time2 weeks ago

Product Buying + Technology1 week ago

Product Buying + Technology1 week ago