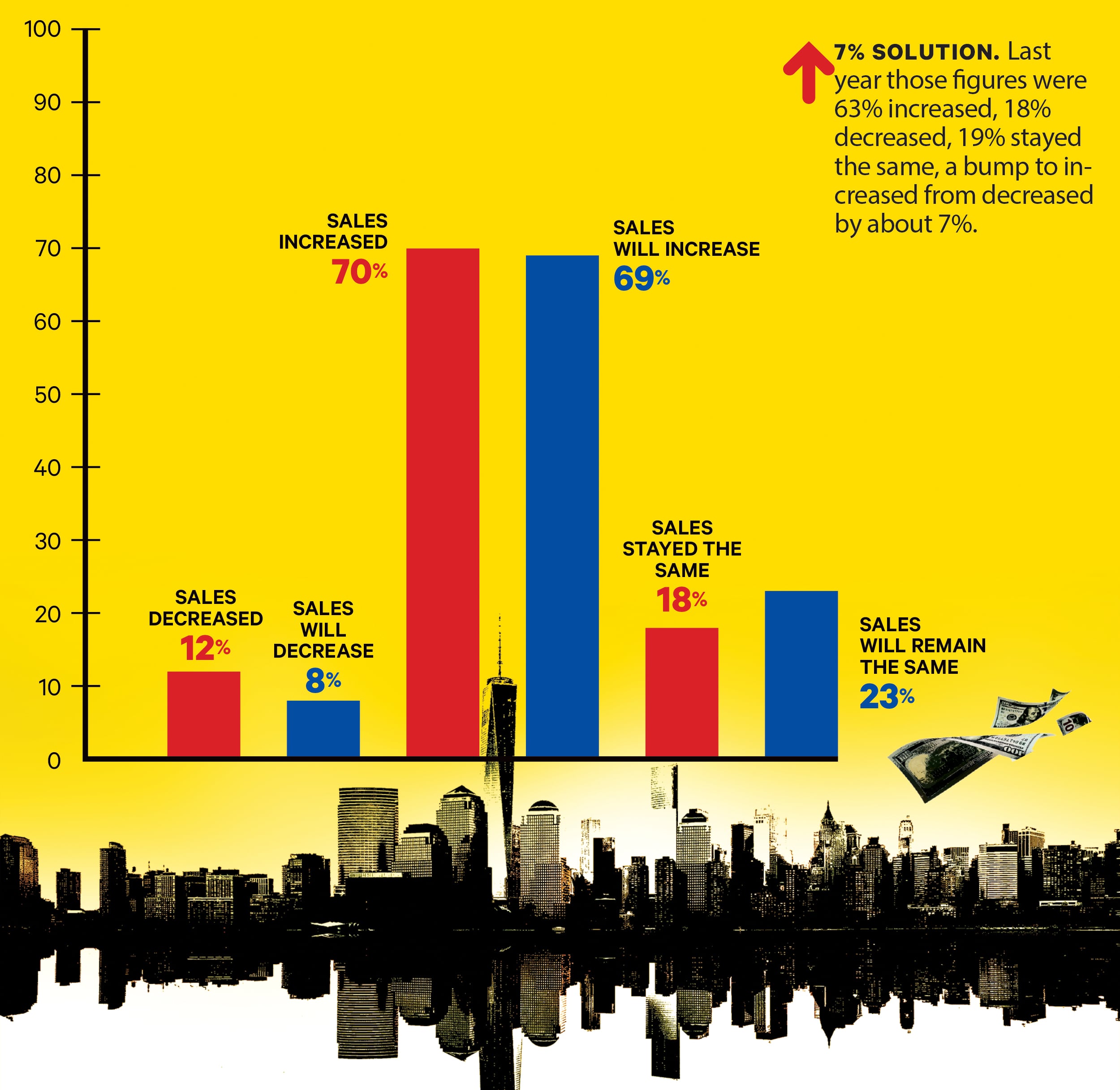

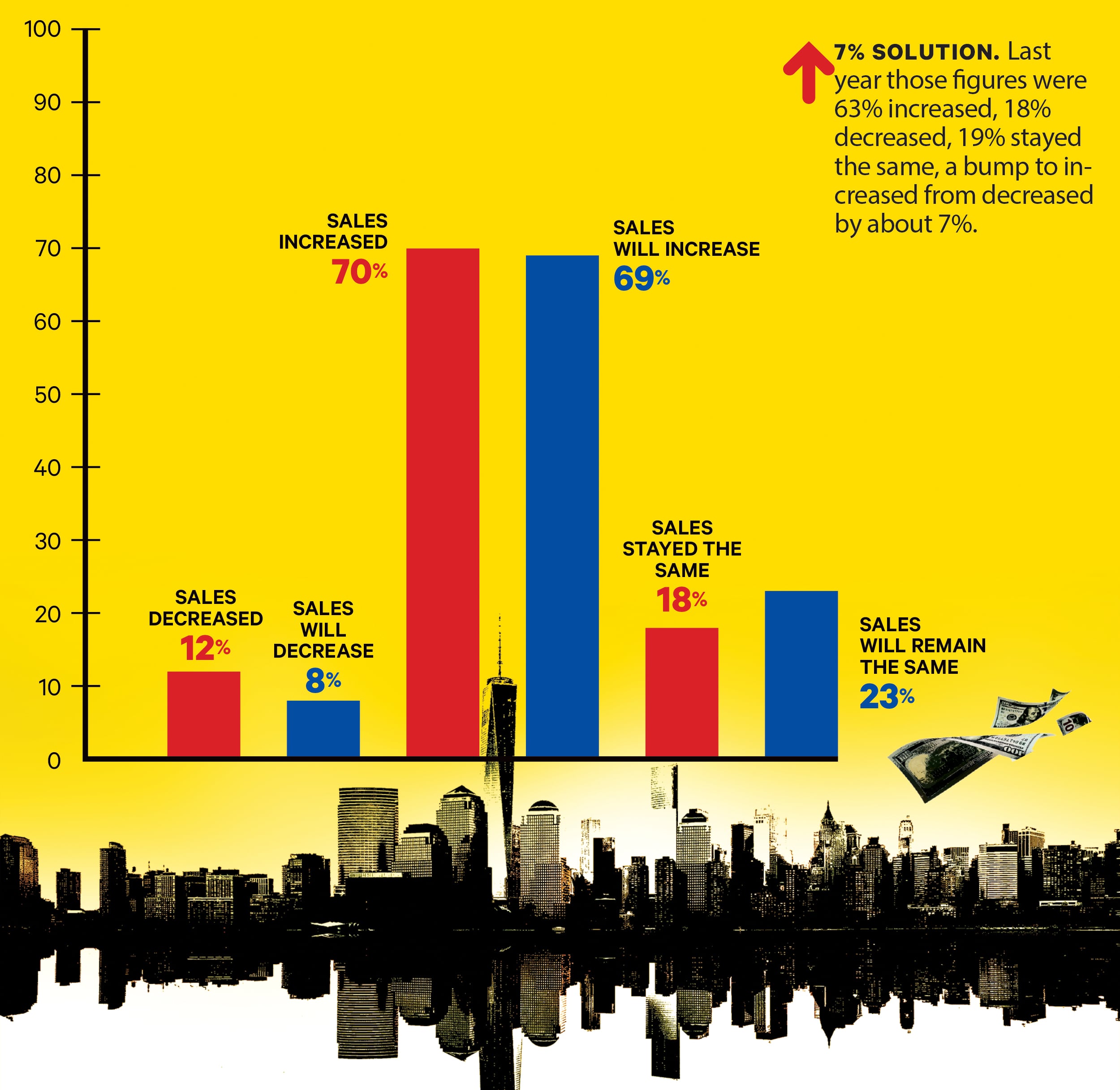

38. How did your company’s sales volume change from 2021 to 2022? How do you expect it to change from 2022 to 2023?

WHAT RECESSION? Though not quite as buoyant as 2022’s predictions that 73% will increase, 6% will decrease and 21% will remain the same, expectations remain high.

39. For 2022, in what range was your company’s average net profit as a percentage of sales?

| Under 5% |

|

11%

|

| 5% to 10% |

|

14%

|

| 10%+ to 20% |

|

36%

|

| 20%+ to 30% |

|

24%

|

| 30%+ to 40% |

|

11%

|

| More than 40% |

|

4%

|

PROFITS CENTERED. While we captured this data in ranges (and not numbers) this year, graphing the above suggests an average in the low-20% vicinity for 2022’s net profits, right around our calculation of 21% for the year before that.

40. For 2023, in what range do you expect your company’s average net profit to be?

| Under 5% |

|

2%

|

| 5% to 10% |

|

17%

|

| 10%+ to 20% |

|

35%

|

| 20%+ to 30% |

|

27%

|

| 30%+ to 40% |

|

14%

|

| More than 40% |

|

5%

|

GOAL ORIENTED. One budgeting axiom is that a goal should never be reached. The figures above reflect a hopefulness, with an average in the mid-to-high 20% range, again, similar to last year’s goal of 25% — which apparently was not quite reached this year — so, nice goal setting!

41. In 2022, what range represents your company’s investment in equipment?

| $0 — We spent nothing |

|

14%

|

| $1 to 10,000 |

|

25%

|

| $10,000+ to $20,000 |

|

11%

|

| $20,000+ to $50,000 |

|

15%

|

| $50,000+ to $100,000 |

|

10%

|

| More than $100,000 |

|

25%

|

SPENDING SPREE. In our 2020 State of the Industry survey, 38% of respondents reported investing nothing in equipment. In 2022, that figure shrank to 32%. With only 14% declaring nothing spent in 2022, more sign companies appear to have invested in equipment, and a lot, to boot: 35% invested $50,000 or more, compared to our 2022 average of $55,200.

42. What equipment did your company purchase in 2022? (Check all that apply.)

| Bucket/crane truck |

|

18%

|

| Channel letter/metal bender |

|

5%

|

| CNC router |

|

11%

|

| Digital printer |

|

30%

|

| Laminator |

|

15%

|

| Laser engraver/cutter |

|

11%

|

| Software |

|

36%

|

| Vinyl-cutting plotter |

|

16%

|

| None |

|

18%

|

| Other (see below) |

|

20%

|

WHAT A TOOL. 3D printers, air compressor, application table, Bobcat, computers, laptops and software; DTG machine, paint equipment, spray booth; PCB assembly equipment, scissor lift, screen printing equipment, trucks, pickup and delivery; welder.

43. In 2023, what range represents your company’s expected investment in equipment?

| $0 — Expect to spend nothing |

|

17%

|

| $1 to 10,000 |

|

24%

|

| $10,000+ to $20,000 |

|

17%

|

| $20,000+ to $50,000 |

|

15%

|

| $50,000+ to $100,000 |

|

17%

|

| More than $100,000 |

|

10%

|

TAPPING THE BREAKS. Expected investment for 2023 looks slightly lower, exemplified by more than $100,000 reported spent by 25% of participants in 2022, but only 10% planning six-figure purchases this year.

44. At present, which of the following do you think is the greatest threat to the sign industry?

| Increasing number of other sign companies (market saturation) |

|

7%

|

| Increasing competition from other sign companies on pricing |

|

13%

|

| Increasing competition from non-sign companies |

|

19%

|

| Recruiting and retaining staff |

|

38%

|

| Not diversifying or keeping up with changing demands |

|

14%

|

| Other (see below) |

|

9%

|

TRENDSPOTTING. Recruiting and retaining staff continues to concern more sign pros every year. The 38% reporting it as the greatest threat to the sign industry this year, are up from 34% in 2022 and only 19% in 2020. The economy, inflation, government and all of the above led the “other” category.

Advertisement

Tip Sheet3 days ago

Tip Sheet3 days ago

Business Management1 week ago

Business Management1 week ago

Women in Signs2 weeks ago

Women in Signs2 weeks ago

Real Deal4 days ago

Real Deal4 days ago

Editor's Note1 week ago

Editor's Note1 week ago

Line Time2 weeks ago

Line Time2 weeks ago

Product Buying + Technology1 week ago

Product Buying + Technology1 week ago

Women in Signs4 days ago

Women in Signs4 days ago