LEDs + Lighting

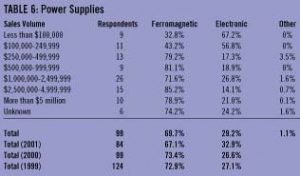

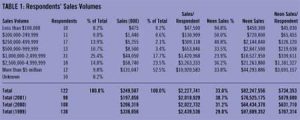

The Fourth Annual Neon/Lighting Survey

All results suggest stability with regard to illumination preferences and prevalence.

Introducing the Sign Industry Podcast

The Sign Industry Podcast is a platform for every sign person out there — from the old-timers who bent neon and hand-lettered boats to those venturing into new technologies — we want to get their stories out for everyone to hear. Come join us and listen to stories, learn tricks or techniques, and get insights of what’s to come. We are the world’s second oldest profession. The folks who started the world’s oldest profession needed a sign.

-

Tip Sheet4 days ago

Tip Sheet4 days agoAlways Brand Yourself and Wear Fewer Hats — Two of April’s Sign Tips

-

Business Management2 weeks ago

Business Management2 weeks agoWhen Should Sign Companies Hire Salespeople or Fire Customers?

-

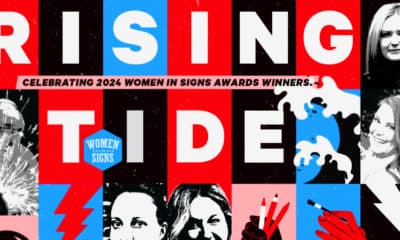

Women in Signs2 weeks ago

Women in Signs2 weeks ago2024 Women in Signs Award Winners Excel in Diverse Roles

-

Real Deal5 days ago

Real Deal5 days agoA Woman Sign Company Owner Confronts a Sexist Wholesaler

-

Benchmarks19 hours ago

Benchmarks19 hours ago6 Sports Venue Signs Deserving a Standing Ovation

-

Editor's Note1 week ago

Editor's Note1 week agoWhy We Still Need the Women in Signs Award

-

Line Time2 weeks ago

Line Time2 weeks agoOne Less Thing to Do for Sign Customers

-

Product Buying + Technology1 week ago

Product Buying + Technology1 week agoADA Signs and More Uses for Engraving Machines