News

Your Signshop Is Unlikely to Pay Higher Income Taxes Under Biden: Treasury

New analysis says proposed tax hike won’t impact 97 percent of small businesses.

Introducing the Sign Industry Podcast

The Sign Industry Podcast is a platform for every sign person out there — from the old-timers who bent neon and hand-lettered boats to those venturing into new technologies — we want to get their stories out for everyone to hear. Come join us and listen to stories, learn tricks or techniques, and get insights of what’s to come. We are the world’s second oldest profession. The folks who started the world’s oldest profession needed a sign.

-

Tip Sheet1 week ago

Tip Sheet1 week agoAlways Brand Yourself and Wear Fewer Hats — Two of April’s Sign Tips

-

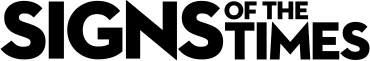

Photo Gallery2 days ago

Photo Gallery2 days ago30 Snapshots of the 2024 ISA Sign Expo

-

Ask Signs of the Times4 days ago

Ask Signs of the Times4 days agoWhy Are Signs from Canva so Overloaded and Similar?

-

Real Deal2 weeks ago

Real Deal2 weeks agoA Woman Sign Company Owner Confronts a Sexist Wholesaler

-

Benchmarks1 week ago

Benchmarks1 week ago6 Sports Venue Signs Deserving a Standing Ovation

-

Women in Signs2 weeks ago

Women in Signs2 weeks ago2024 Women in Signs: Megan Bradley

-

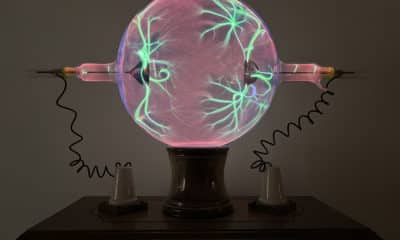

Photo Gallery1 week ago

Photo Gallery1 week ago21 Larry Albright Plasma Globes, Crackle Tubes and More

-

Women in Signs1 week ago

Women in Signs1 week ago2024 Women in Signs: Ashley Borell